Prudent empowers organizations with science-driven climate intelligence, helping you anticipate risks, safeguard investments and build resilience in a warming world.

Prudent empowers organizations with science-driven climate intelligence—helping them anticipate risks, safeguard investments, and build resilience in a warming world.

Use Cases:

Key Benefits:

Use Cases:

Use Cases:

Key Benefits:

Use Cases:

Key Benefits:

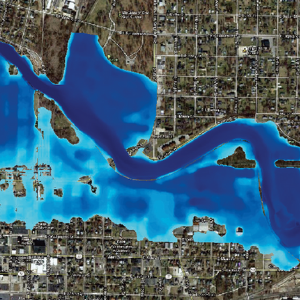

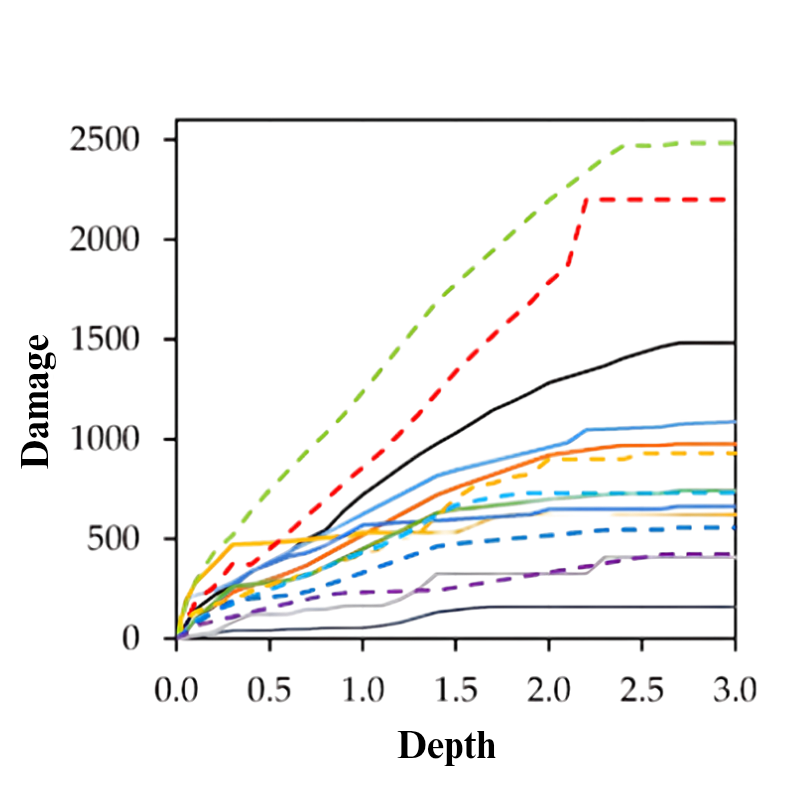

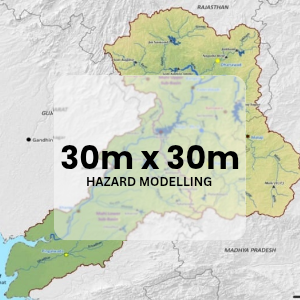

Assess Climate Hazard footprint & its financial impact across multiple assets (e.g. highways) for baseline and future climate change scenarios

Outputs

Benefits

2. Strengthen investor confidence through robust climate risk management

Assess Climate Hazard footprint & its financial impact across multiple assets (e.g. highways) for baseline and future climate change scenarios

Outputs

Benefits

2. Strengthen investor confidence through robust climate risk management

To help the NBFC understand, manage, and reduce physical climate risks in its MSME portfolio through sector-specific risk intelligence and climate resilience planning.

Outputs

Benefits

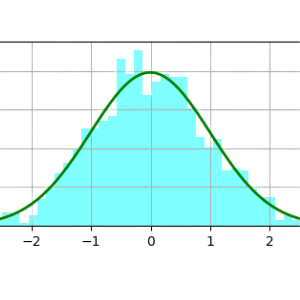

2. Climate change scenario analysis and stress testing for the portfolio

To help the NBFC understand, manage, and reduce physical climate risks in its MSME portfolio through sector-specific risk intelligence and climate resilience planning.

Outputs

Benefits

2. Climate change scenario analysis and stress testing for the portfolio

Fintech wanted to provide an enhanced risk offering to its clients – with climate risk insights.

Ingest location, sector and asset specific inputs and return physical climate risk and resilience insights as-a-service

Benefits

Fintech wanted to provide an enhanced risk offering to its clients – with climate risk insights.

Ingest location, sector and asset specific inputs and return physical climate risk and resilience insights as-a-service

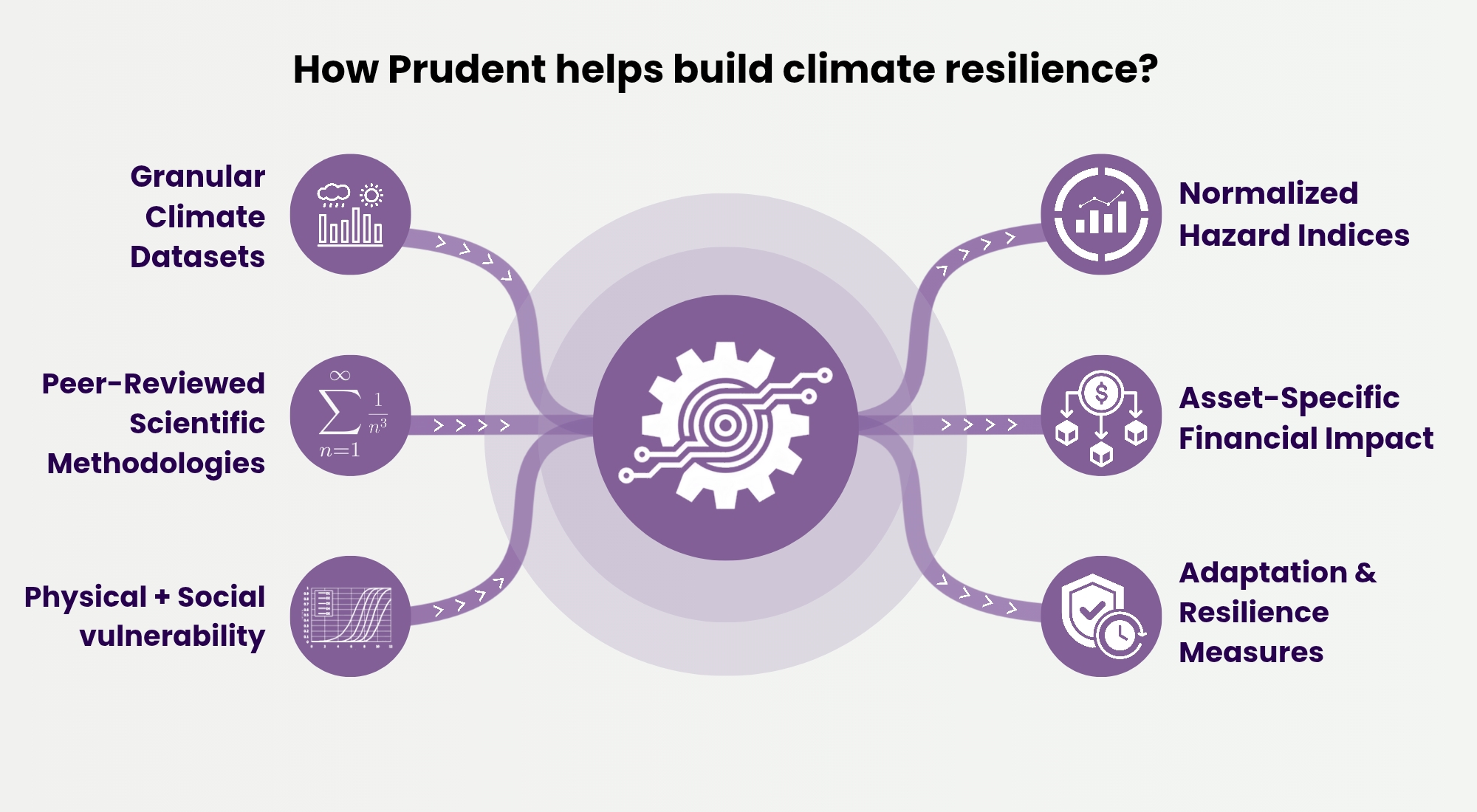

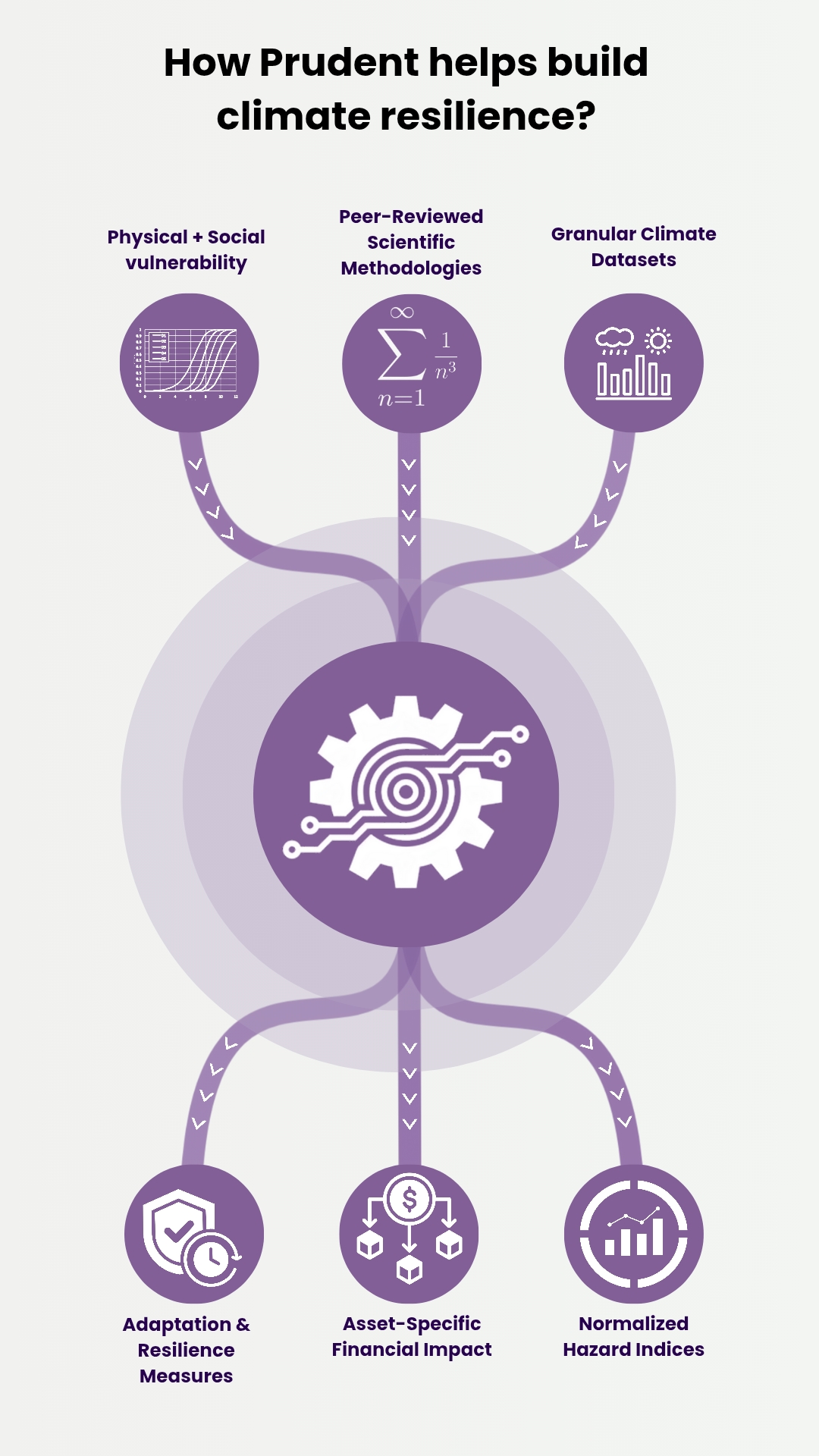

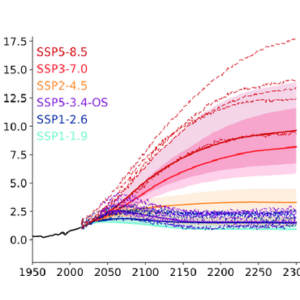

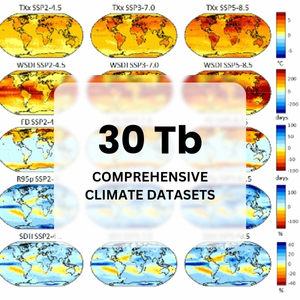

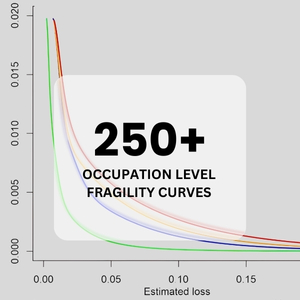

Prudent is a deep-tech tool designed to embed climate risk management and resilience directly into everyday business operations. It delivers in-depth, sector-wise and scenario-wise insights on hazards and their financial impacts, holistic vulnerability combining physical and social dimensions and tailored adaptation and resilience measures. With a modular and customizable design, Prudent empowers businesses of all sizes to seamlessly integrate forward-looking climate intelligence into their workflows, strengthening decision-making, safeguarding investments, and building long-term resilience.

Dygnify Ventures Private Limited,

91 Springboard Business Hub Pvt Ltd,

Kalina, Bandra Kurla Complex,

Santacruz East, Mumbai 400098

Dygnify Ventures Private Limited,

91 Springboard Business Hub Pvt Ltd,

Kalina, Bandra Kurla Complex,

Santacruz East, Mumbai 400098

hello@dygnify.com